Primary Responsibility for the Financial Statements Lies With

A carhop then delivers the food to the customer. That the audit was made in accordance with auditing standards generally accepted in the United States.

Oversight And Accountability Boardsource Accounting Board Report Report Template

Securities and Exchange Commission.

. External auditors are responsible for auditing the companys financial statements and providing reasonable assurance that they are presented fairly and in conformity with GAAP and that they reflect true representation of the companys financial position and. Determining Financial Statement Effects for Bonds Held to Maturity. The responsibility of making the financial statements lies with the management of the company while external auditors can only express their opinion that whether the financial statements presents true and fair view of the financial position and the financial affairs of the company.

Primary responsibility for the financial statements lies with Auditors Management. Customers order at a drive thru dine on the patio or drive up to a canopied parking space. Primary responsibility for the financial statements lies with.

Management of the company. Operates and franchises a chain of quick-service drive-in restaurants in most of the United States. Auditor in charge of the fieldwork.

Primary responsibility for the financial statements lies with. Partner assigned to the audit engagement. B Selecting samples for audit testing.

The organization s management. A Partner assigned to the audit engagement B Management of the company C Auditor in charge of the fieldwork D Securities and Exchange commission. In this regard what are the roles and responsibilities of an external auditor.

OTHER SETS BY THIS CREATOR. The primary responsibility for preventing fraud in an organization lies with. Managements responsibility for the financial statements includes.

An audit is an examination of the financial statements provided by management to ensure that they represent what they claim and to make sure that they are in compliance with generally accepted accounting principles. Securities and Exchange Commission. Auditor in charge of the fieldwork.

Partner assigned to the audit engagement. Multiple Choice the audit committee of the board of directors. Which of the following statements is true when considering central banks.

The primary responsibility for the adequacy of disclosure in the financial statements of a publicly held company rests with the. The number of central banks in the world grew enormously after the Great Depression. Management of the company.

Upvote 1 Downvote 0 Reply 0. A Selecting internal controls tests. Even though the primary responsibility for preparation of financial statements lies with the management and Those Charged With Governance TCWG the auditors play a pivotal role in providing an independent assurance on the accuracy of the financial statements.

The first central bank was the Bank of England established by Parliament in 1694. As stated in the audit report or Report of Independent Accountants the primary responsibility for a companys financial statements lies with. FASB creates SEC GAAP creates FASB SEC creates AICPA FASB creates US.

The primary responsibility for the adequacy of disclosure in the financial statements of a publicly held company rests with the. Key responsibilities over Financial Statements. As stated in the audit report or Report of Independent Accountants the primary responsibility for a companys financial statements lies with The company management which of the following is true.

The internal audit function. Every nation in the world has a central bank that influences the world. Which of the following is explicitly included as a part of the description of managements responsibility in an unmodified audit report.

Answer to Solved Primary responsibility for the financial statements. For doing so an auditor applies hisher values experience and skills to emerging. Who has primary responsibility for the information in the financial statements.

C Selecting and applying appropriate accounting policies. D Selecting experts to assist with testing asset valuations. That the audit was made.

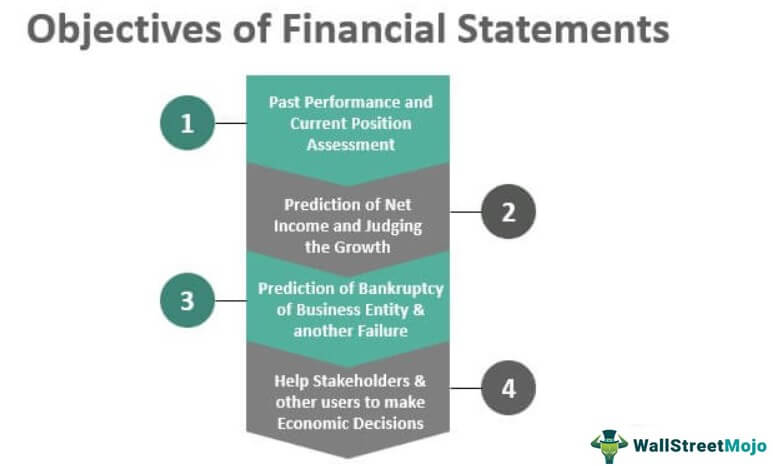

Option B The term financial statement is concerned with a business and its related reports. The general purpose financial statements help to provide useful information to the primary users in making their economic decisions about providing resources to the entity. The auditors report for a nonpublic company should indicate That the audit was made in accordance with auditing standards generally accepted in the United States of America.

It comprises of a cash flow statement the. Econ of Trade Policy Final Exam. Management is responsible for the maintenance of internal control.

Primary responsibility for the financial statements lies with. The owners of the company. The primary responsibility for the adequacy of disclosure in the financial statements of a publicly held company rests with the.

The primary responsibility for the content of the financial statements lies with the external auditor. The auditors report for a nonpublic company should indicate. Click to see full answer.

GAAP FASB creates US. Primary responsibility lies with management represented by the highest officer of the company and the highest financial officer. This requires the management to present the Financial Statements with complete knowledge and understanding regarding the procedure to be followed.

Additionally it also helps users to assess the performance and accountability of the entity in utilising the resources provided to them. This involves preparing the financial statements in accordance with the rules and regulations set out by the governing accounting body.

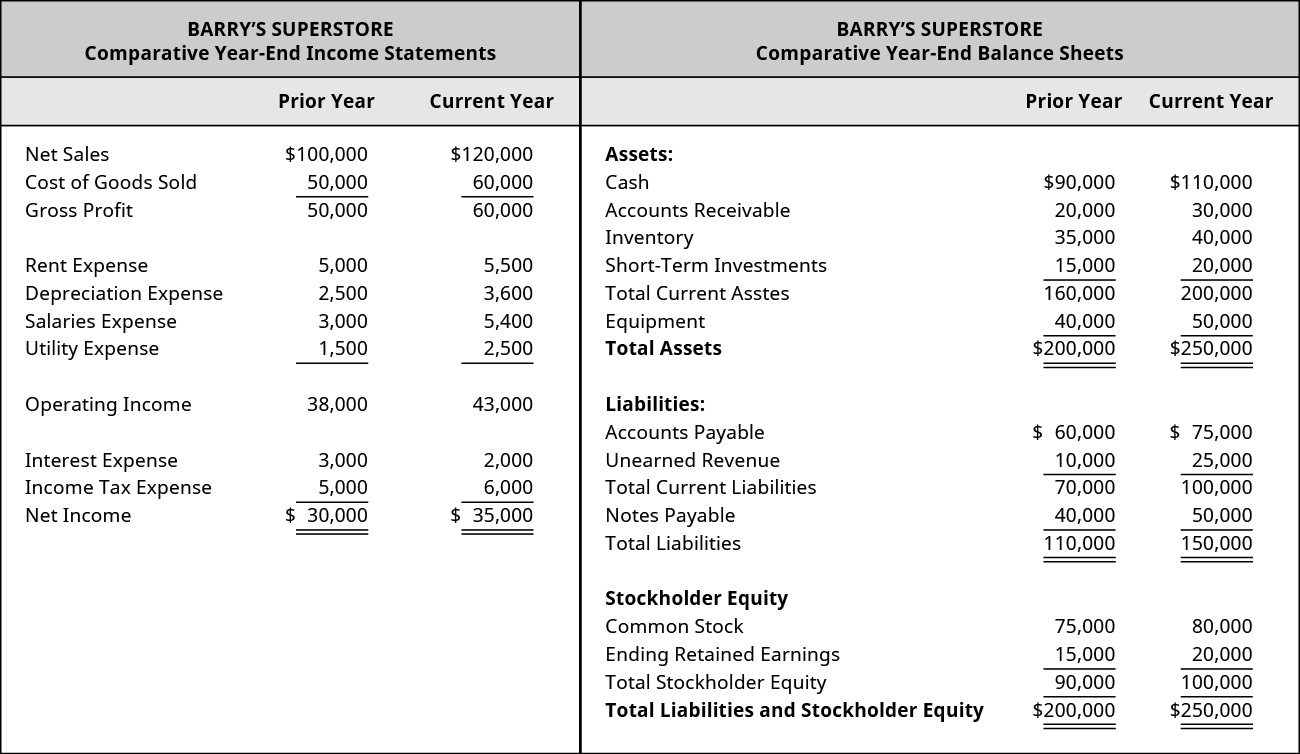

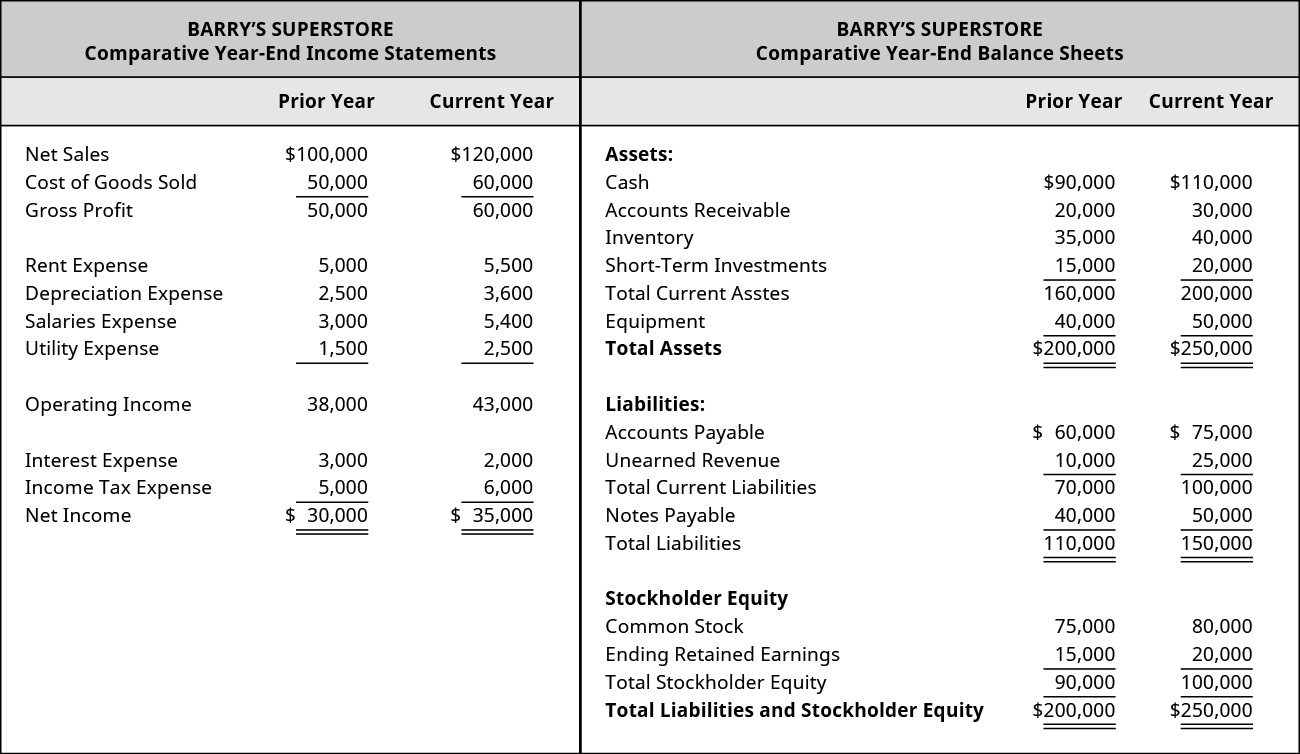

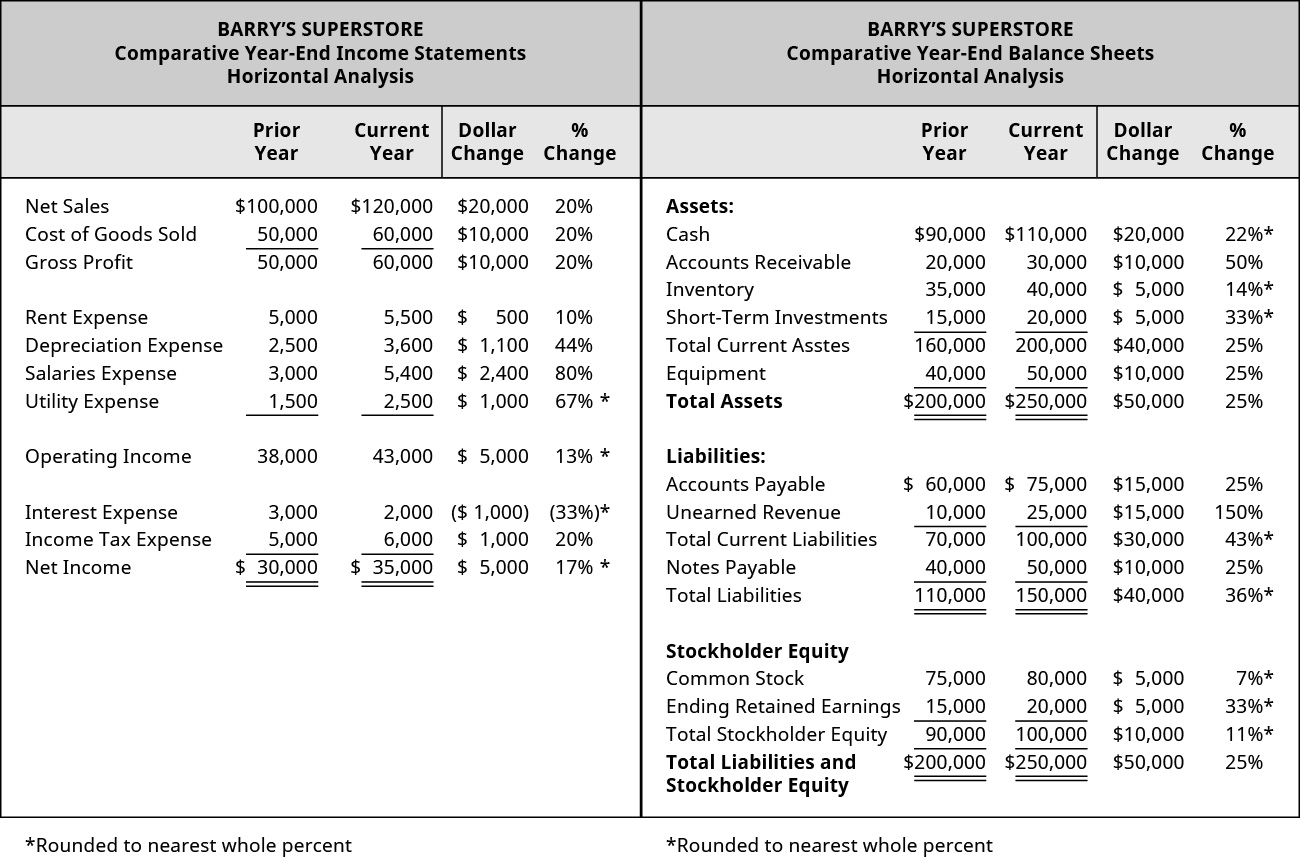

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Financial Statement Analysis Principles Of Accounting Volume 1 Financial Accounting

Audit Review And Compilation How Cpa Reports Differ Grf Cpas Advisors

No comments for "Primary Responsibility for the Financial Statements Lies With"

Post a Comment